Business Solutions

Valeo+ is a true strategic partner committed to helping companies prosper. As a national supplier, we are in a position to assess what is available in your field of activity and offer you a competitive and innovative solution consistent with your goals. We ensure that your contribution in terms of social benefits delivers the best possible return on investment.

STOP MANAGING EMPLOYEE BENEFITS.

START FOCUSING ON EMPLOYEE WELLNESS.

WHY CHOOSE VALEO+ AS YOUR PARTNER?

To work with a company at a human scale that is fully invested in your reality and your success while able to adapt with great agility.

To benefit from the flexibility of an independent firm when it comes to choosing employee benefit solutions appropriate for the size of your company.

To finally have a clear view of your plan’s data, performance and impact.

To stand out from the market with an employer brand enhanced by the quality of our day-to-day involvement.

OUR WORKPLACE FINANCIAL WELLNESS PROGRAM

OUR WORKPLACE FINANCIAL WELLNESS PROGRAM

The program we have developed is simple and effective. The goal is to improve employees’ overall financial position.

To reach this goal, we work on three key factors:

1. Reduce financial stress

2. Build financial literacy

3. Improve financial wellness

The success of this program is based not only on its design, but also on the quality of the products and services as well as the personalized support provided by our advisors.

It is easy to set up within your organization and you will see results within the first few months following implementation.

HOW FINANCIAL STRESS IMPACTS COMPANIES

%

Canadian workers who spend three work hours or more per week on financial issues¹

%

Canadian workers who are less productive at work due to financial stress²

%

Canadian workers who believe that employers should support their financial wellness³

1. Financial Consumer Agency of Canada. Infographic: Calculating the cost of employee financial stress on productivity – Canada.ca

2. Canadian Payroll Association– NPW 2019 Employee Research Survey. CPA-2019-NPW-Employee.aspx (payroll.ca)

3. Sun Life Financial, “Empowering Employees to Improve Their Financial Wellness” (2017), pp. 9-10.

CHOOSE THE RIGHT GROUP RETIREMENT SAVINGS PLAN

When it’s a question of optimizing a group retirement savings plan, our goal is simple:improve your experience as plan sponsor while upgrading the plan parameters to enable your employees to attain their retirement goals.

The following elements come into play whensetting up a plan:

- Characteristic structure

- Administration fees

- Changes in assets

- Investment options

- Governance

- Industry peer comparison

- Recommendations and action plan

DISCOVER OUR GROUP INSURANCE SOLUTIONS

Our proven approach to comprehensive health management necessarily involves a high-performance group insurance plan. Our actuarial analyses will show you several years in advance how the cost of benefits for your plan is going to evolve, and this will enable you to make better decisions.

The following variables are taken into account to implement the best solution;

- Administration fees

- Reserves

- Pooling fees

- Trend factor

- Credibility

- Demography

- Quarterly experience reports

- Renewal projections

- Market trend tracking

OTHER SERVICES

Telemedicine

We can integrate virtual health care services with your group insurance so as to provide proactive handling of physical and mental health problems.

Employee Assistance Program

We work in conjunction with the programs offered by the selected insurer and enhance the service offering with our various partners to customize and tailor your EAP.

HR Consultant and Business Solutions

Our partner EPSI will revitalize your talent evaluation, engagement and evolution activities.

Workplace Harassment Intervention

Our doctoral fellow in experimental psychology is here to help you take a position when dealing with harassment or interpersonal conflicts.

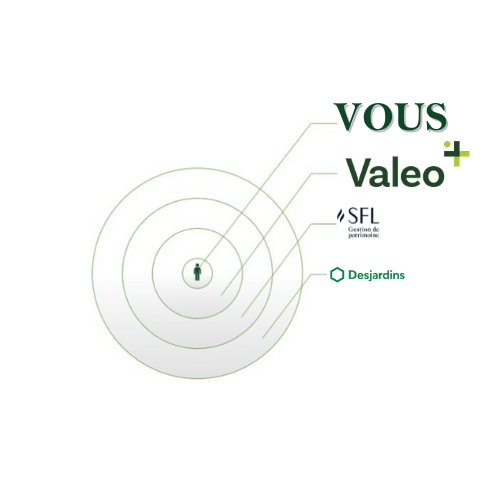

OUR PARTNERS

LET’S TALK

Connect with us! We’ll provide you with a proposal built around your needs.

QUEBEC CITY

725 Lebourgneuf Blvd., Suite 401

Quebec City, Quebec G2J 0C4

(418) 658-7382

MONTREAL

6400 Auteuil Ave., Suite 300

Brossard, Quebec J45 3PZ

© All rights reserved | Valeo Plus

TOLL FREE

1 844 893-7376