Group retirement savings plan

Help secure your employees’ financial future with a group retirement savings plan tailored to your needs and those of your teams.

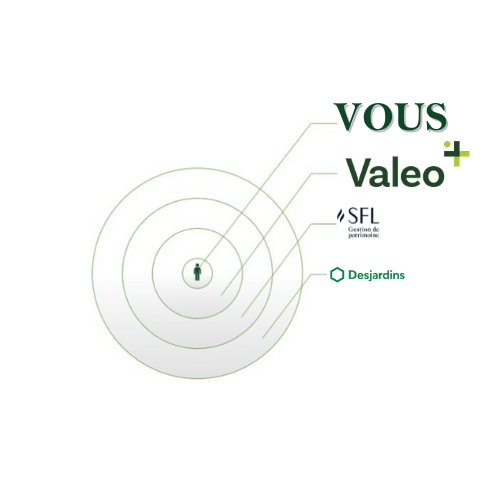

Take advantage of Valeo+ benefits

TAX OPTIMIZATION

Take advantage of our expertise to develop tax strategies that will help you maximize every dollar invested in your plan.

GOVERNANCE MANAGEMENT

We support you in the administration of your plan by equipping you and ensuring that you comply with the standards and rules in force. We ensure that these obligations are not only met, but also clearly communicated to all plan members.

100% FLEXIBLE PLANS

Your group retirement savings plan

SOLUTIONS FOR RETIREES

We offer solutions and tools specifically designed for your retiring employees, so that they can continue to benefit from mentoring.

what is a Group Retirement Savings Plan?

A group pension plan is a benefit offered by a company to its employees as part of their benefits package. Employers offer these plans because they enhance the employer brand and serve as incentives to attract and retain staff. What’s more, the employer’s contribution is tax-advantaged.

Employee contributions are invested in pre-selected stocks

For employees, it’s a simple way to save for retirement or other financial goals.

choose the right group retirement savings plan

As an independent firm, we have agreements with all the major suppliers in the country, ensuring a solution that’s 100% aligned with your needs and budget. Here are some of the types of accumulation plans available:

The group RRSP is a contract generally established by the employer or a union, to allow the payment of contributions to individual RRSPs. In general, only the participant contributes. The group RRSP simplifies systematic savings by withdrawing the amounts paid directly from the payroll. Its administration is centralized and its management costs are lower.

The group TFSA for businesses allows participants to benefit from a tax-sheltered investment vehicle. Withdrawals are tax-free and can be made at any time. The employer can also contribute up to a maximum established by the employer.

It is a contract whereby the employer shares part of the profits of the company with the workers. Only the employer can contribute to a RPDB and this determines the conditions of membership in the plan and those for the withdrawal of accumulated sums by workers.

The RRS is a defined contribution plan in which the amount of contributions is fixed in advance, but not the amount of retirement income. The employer’s contribution is locked in, while the employee’s contribution may or may not be locked in, at the employer’s discretion. It is important to note that the locked-in amounts must be used to provide retirement income and can only be withdrawn under certain very strict conditions.

The RRS is administered by a financial institution. Each participant selects his investments from choices provided by the financial institution. The RRS was designed for SMEs, but is suited to businesses of all sizes.

The amount of contributions to a defined contribution plan is fixed in advance, but not the amount of retirement income.

Members’ DCP retirement income depends on the amounts credited to their individual accounts. The sums paid to them are therefore accounted separately from those of other participants.

The financial risk associated with the plan depends on the performance of the investments and is assumed by the participant.

Usually, the plan is administered by a pension committee and, in some cases, by the employer.

the FINANCIAL v+ wellness program

the FINANCIAL v+ wellness program

Automatically added to your new group savings plan, our financial wellness program is designed to improve employees’ overall financial situation.

In order to reach this target, we are working on 3 key elements:

1. Reducing financial stress

2. Building financial literacy

3. Improving financial well-being

The success of this program is based on both its design and the quality of the products and services as well as on the personalized support of our advisers.

Its implementation in your organization is easy and you will be able to appreciate its results from the first months following its establishment.

OUR COMPLEMENTARY SERVICES

Group Retirement Savings Plan

Solutions for executives and shareholders

Telemedecine

Employee Assistance Program (EAP)

Health and Wellness Account

Benefits audit

Solution for newcomers to Canada

Enhance your employer brand and make it easier to achieve your organizational goals by working with a benefits firm on a human scale.

Let’s build a program that’s right for you!

contact us.

QUEBEC CITY

725 Lebourgneuf Blvd, Suite 401

Quebec City, Quebec G2J 0C4

(418) 658.7382

MONTREAL

6400 Auteuil Avenue, Suite 300

Brossard, Quebec J45 3PZ

© All rights reserved | Valeo Plus

FREE OF CHARGE

1 844 893.7376

info@valeo.plus